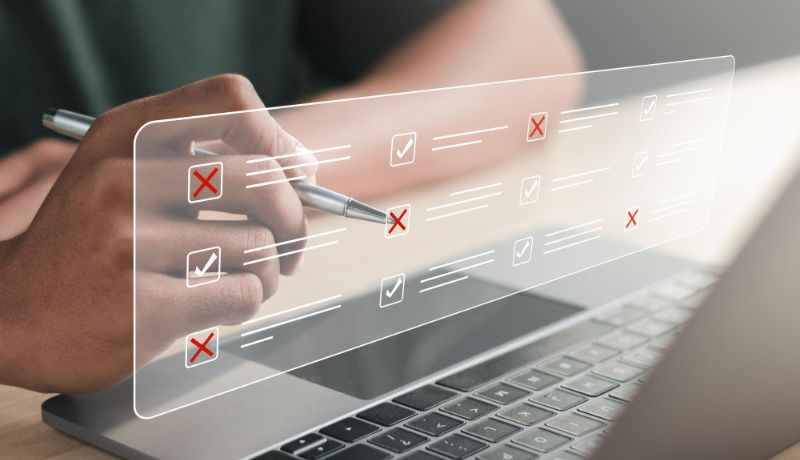

Income Escaping Assessment / Re-assessments Under the Income-tax Act, 1961

Section 148 of the Income-tax Act, 1961 gives authority and power to the Assessing Officer to reassess the previously filed return of income by sending notices to the assessee whose income has not been properly assessed or has not been disclosed for taxation (Income escaping assessment). This implies that if the Assessing Officer suspects that […]