Foreign Asset Disclosure in ITR: Implications under Black Money Act

Foreign Asset Disclosure in ITR: Implications under Black Money Act

Black Money Act: Know about reporting foreign assets, what qualifies as a foreign asset, and the penalties for non-compliance under the Black Money Act.

- Last Updated

Black Money (Undisclosed Foreign Income and Assets) and Imposition of Tax Act, 2015 prescribes taxation of any undisclosed foreign income and foreign assets. The law has been formulated to curb the menace of black money stashed away abroad by Indians. In this blog, we examine the categories of residents who are required to report foreign assets, the types of foreign assets, and the consequences of non-compliance with the applicability of penalties or punishment under the Black Money Act.

Reporting of Foreign Assets in Income Tax Return (ITR)

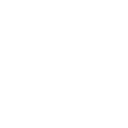

If residents of India hold foreign assets as a beneficial owner or is a beneficiary in any asset located outside India including financial interest in an entity located outside India or has signing authority in any accounts located outside India; then they are liable to report their foreign assets in their ITR regardless of whether they have taxable income or not.

Categories of residents who report foreign assets in ITR if they hold the foreign assets, irrespective of whether they have taxable income or not.

Types of Foreign Assets Disclosures to be Reported in their ITR

The following are the types or examples of foreign assets:

- Bullion, jewelry or precious stone

- Archaeological collections, drawings, paintings, sculptures or any work of art (artistic work)

- Quoted shares and securities

- Unquoted shares and securities

- Immovable property

- Bank accounts

- Value of an interest of a person in a partnership firm or in an association of person or a limited liability partnership of which he is a member

- Any other assets such as motor car, boat, aircraft, yacht, ship, machinery, intellectual property rights etc.

Categories of Reporting of Foreign Assets Disclosures in ITR

- Foreign depository accounts

- Foreign custodian accounts

- Foreign equity and debt interest

- Foreign cash value insurance contract or annuity contract

Related Read: FDI in India: Legal Framework and Impact on Growth

- Financial interest in any entity outside India

- Any immovable property outside India

- Any other capital assets outside India

- Any other accounts located outside India in which the resident person has a signing authority which is not reported above

- Any trust created outside India in which the resident person is a trustee or beneficiary or settlor

- Income derived from any foreign source which is not reported above

Consequences of the Applicability of Penalty and/or Punishment under the Black Money (Undisclosed Foreign Income and Assets) and Imposition of Tax Act, 2015

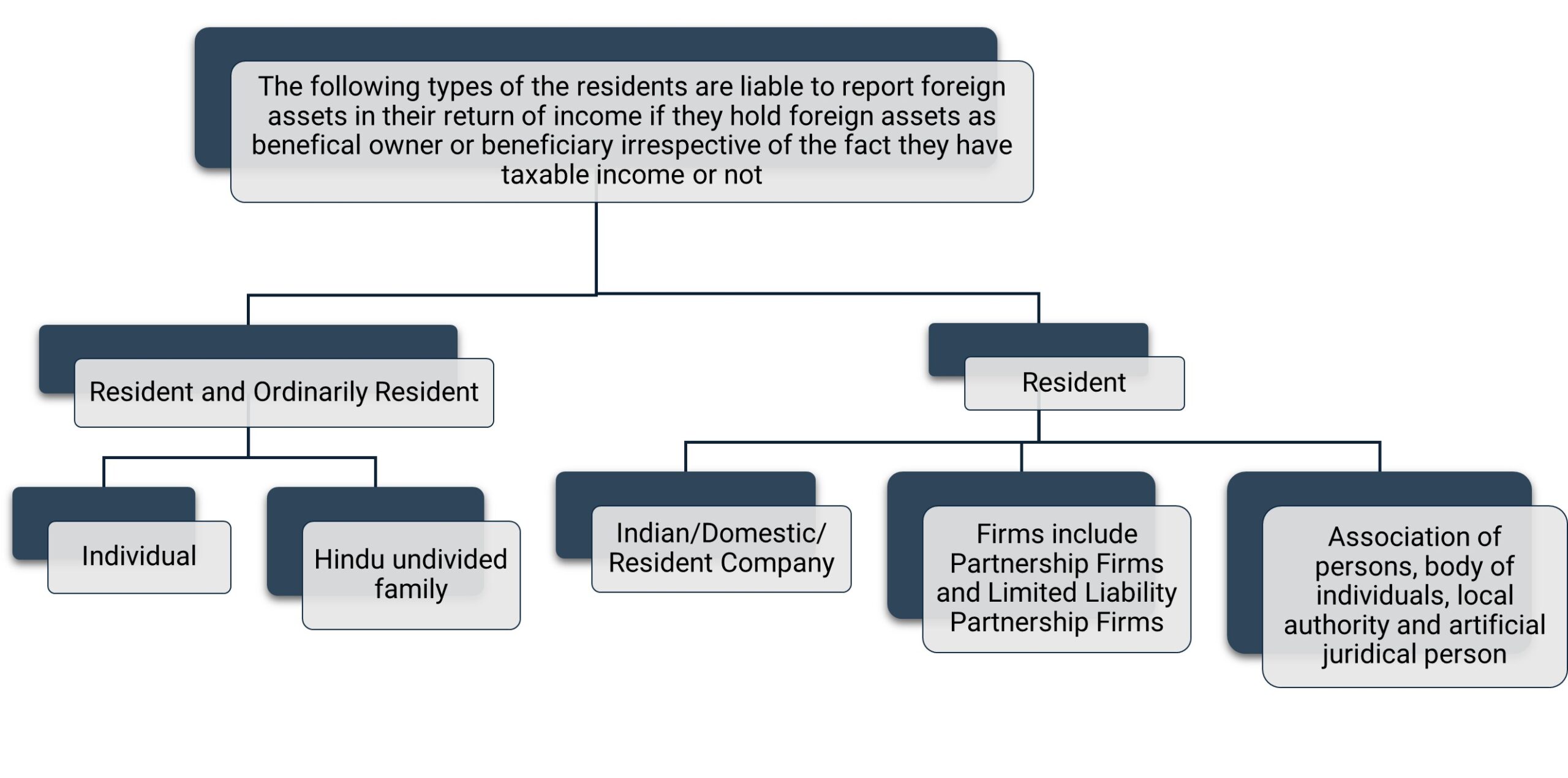

The following penalty and/or punishment will be applicable to a resident person who holds foreign assets as beneficial owner or beneficiary but has neither reported nor offered for tax, any income from a source located outside India in their original ITR filed under Section 139(1) – (filed within due date) of Income Tax Act, 1961.

Consequences of the Applicability of Penalty and/or Punishment under the Black Money (Undisclosed Foreign Income and Assets) and Imposition of Tax Act, 2015

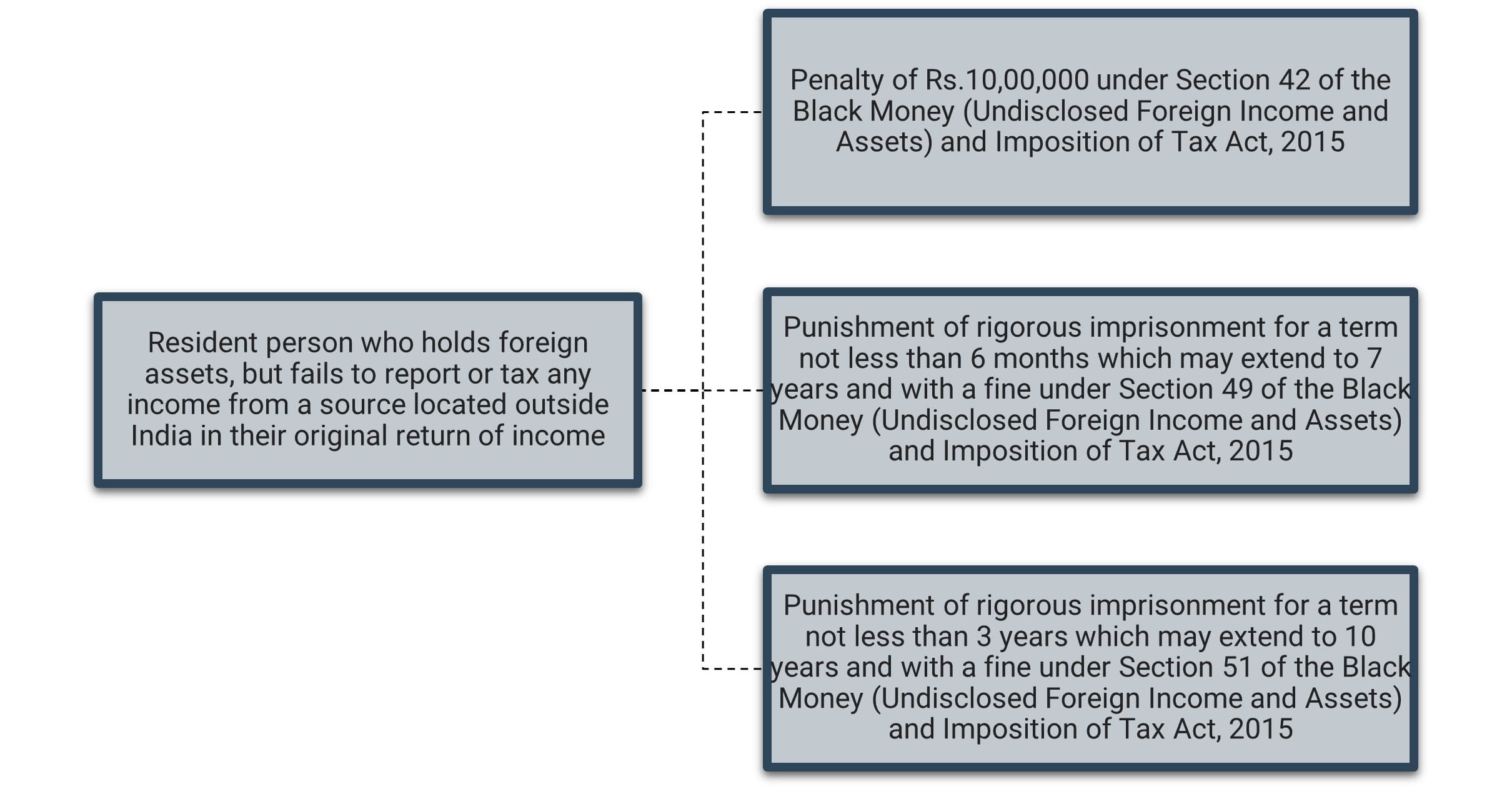

A resident person who holds the foreign assets as beneficial owner or beneficiary and filed their ITR under Section 139(1), 139(4) or 139(5) of the Income Tax Act, 1961 is required to report assets and any income from sources outside India. Failure to do so will attract the following penalty and/or punishment.

Consequences of the Applicability of Penalty under the Black Money (Undisclosed Foreign Income and Assets) and Imposition of Tax Act, 2015 if a resident person discloses inaccurate particulars of foreign assets disclosure in ITR.

For example, if a resident person holds the foreign assets as beneficial owner or beneficiary and furnishes inaccurate particulars about their foreign assets or foreign incomes in their ITR, a penalty of Rs.10,00,000/- will be levied under Section 43 of the Black Money (Undisclosed Foreign Income and Assets) and Imposition of Tax Act, 2015.

In case a resident person does not disclose foreign assets or has not offered to tax their foreign income in ITR filed in India, Income Tax Authorities can obtain such information under article of exchange of information under Double Taxation Avoidance Agreements.

Related Read: India-Mauritius Amend Tax Treaty, Introduces PPT

Conclusion

At InCorp, we can assist in analysing various assets held as well as classification under the appropriate reporting head for foreign assets in the return of income. We also provide clear guidance and the way forward to ensure accurate ITR filings for taxpayers.

Listed are some of the scenarios and examples in which we aid resident taxpayers in relation to disclosure of the foreign assets:

1. Reporting of the foreign asset disclosure and disclosure of any income accrued from it in ITR. For example, a resident individual holding foreign retirement benefit accounts like a 401(k) maintained overseas.

2. Joint/second/third account holders of foreign depository accounts or foreign custodial accounts must furnish their foreign assets disclosure while filing ITR, even when no income has been accrued to them.

3. Exchange rates to be applied by resident person (taxpayer)

a) For taxing foreign income in India in ITR.

b) The reporting of the foreign asset disclosure in ITR.

4. The assets to be reported such as foreign depository accounts, foreign custodial accounts, foreign equity or debt interests, foreign cash value insurance or annuity contracts, and financial interests in any entity located outside India. Additionally, capital assets held abroad, accounts where the resident has signing authority, foreign trusts where the resident is a trustee, beneficiary, or settlor, and any other income from foreign sources not specifically mentioned above must also be disclosed.

5. How can a resident individual in India claim foreign tax credit if tax has been deducted or paid in a foreign country, even though the foreign income is also taxable in India?

6. What steps should a resident individual take if they have filed their ITR without disclosing foreign assets and would the provision of Black Money Act be applicable in such an instance?

7. How to respond to a notice under Section 10 of the Black Money Act about inaccurate foreign assets disclosure in ITR?

8. If a resident person holds a foreign asset i.e. immovable property in the UK but does not disclose in ITR in 2020, will an assessing officer impose the penalty of Rs 10,00,000/- for each assessment year until 2025 under the Black Money Act?

9. Example: An immovable property in the USA are jointly owned by Mr. X and Mrs. X who are resident of India during the FY 2024-25, however, there is no income accrued on the same and if Mr. X has disclosed this foreign asset in his ITR and Mrs. X does not disclose in her ITR, will a penalty under Section 43 of the Black Money Act will be imposed on Mrs. X?

10. Example: An XYZ bank account in the UK is jointly owned by Mr. B, Mrs. B and their sons Mr. C and Mr. D. There is bank interest accrued on the same. If Mr. B discloses this as foreign asset in his ITR and offers the bank interest to tax in his ITR for AY 2024-25, but Mrs. B, their sons Mr. C and Mr. D, do not disclose this XYZ bank account in their ITR for AY 2024-25, will a penalty under Section 43 of the Black Money Act be imposed on them?

Why Choose InCorp Global?

At InCorp, our dedicated team of experts simplifies the process, from filing ITR for foreign income disclosure or foreign assets disclosure, responding to notice under Section 10 of the Black Money Act, representation before Income Tax authorities and completing assessment or reassessment proceedings under the Black Money Act, claiming Foreign Tax Credit. We assist in compiling the required documentation and ensure your responses are accurate, complete, and minimize the risk of further queries. If you have any questions or require assistance regarding our process, please write to us at info@incorpadvisory.in or reach out to us at (+91) 77380 66622.

Authored by:

Nilay Jhaveri | International Taxation & FEMA

Share

Share