Empowering Growth of Trade Finance in IFSC

Empowering Growth of Trade Finance in IFSC

Transforming the Future of Receivables in IFSC

- Last Updated

There are remarkable transformations occurring within the financial environment of the International Financial Services Centre (IFSC) after the inception of the International Financial Services Centres Authority (IFSCA). The new regulations are aimed at creating greater efficiency and simplifying the trade finance factoring business– a key tool to stimulate liquidity for businesses or industries. Banking trade finance is diversifying with various options such as factoring that allow businesses to convert receivables into immediate cash to bring liquidity to meet operational or working capital gap continuity. The different trade finance products, especially the factoring mechanism, have played a vital role in the trade finance ecosystem of India, particularly given the framework provided by IFSCA. Understanding its paramount significance, the IFSCA has framed a complete regime that provides a transparent registration process and adheres to sound operational standards to promote factoring opportunities for registered finance Companies. By means of clear guidelines, IFSCA aims to galvanize the global player and foster innovation in a well-regulated environment concerning trade finance involved in factoring activities, particularly in the GIFT IFSC zone.

Registration of Factors:

- Every factor intending to commence factoring business in an IFSC must obtain registration from the IFSCA under IFSCA (Finance company) regulations.

- Registration requirement does not apply to bank or statutory corporation or government company.

Eligibility Criteria:

After reviewing the application, the Authority may grant the registration certificate if the factor meets all the prescribed conditions, including:

- Obtaining a Certificate of Registration under the IFSCA (Finance Company) Regulations, 2021.

- Ensuring the Relevant Persons (Key Managerial Personnel) having adequate experience in factoring.

- Possessing or being willing to invest in the necessary infrastructure (office space, equipment, etc.) to operate in GIFT IFSC.

- Meeting the ‘fit and proper’ criteria and maintaining financial soundness at all times.

- No pre-involvement in any judicial proceedings related to legal breaches.

Net worth Requirement:

As factoring is one of the core activities in the regulation of finance Companies issued by IFSCA. It would be required to maintain minimum owned funds of USD 3 million.

Pre-requisite to Conducting Business:

- Factors must commence their factoring business within six months of receiving the registration under the said regulations.

- Existing finance companies already holding a certificate of registration for undertaking factoring business shall be deemed to be granted registered under these regulations.

- A factor can undertake factoring directly with the assignor or through an ITFS (International Trade Finance System), subject to the applicable laws and regulations.

- Entities other than factors, meeting such eligibility criteria as may be specified by the Authority, may undertake factoring business through an ITFS.

Registration of Assignments of Receivables

- The receivables financed through a Trade Receivables Discounting System (TReDS) must be registered with the Central Registry within ten days of assignment of receivables in favour of Factor or satisfaction of any assignment of receivables (full realisation).

- Every form for registration of any transaction of assignment or satisfaction must be submitted along-with the prescribed fee.

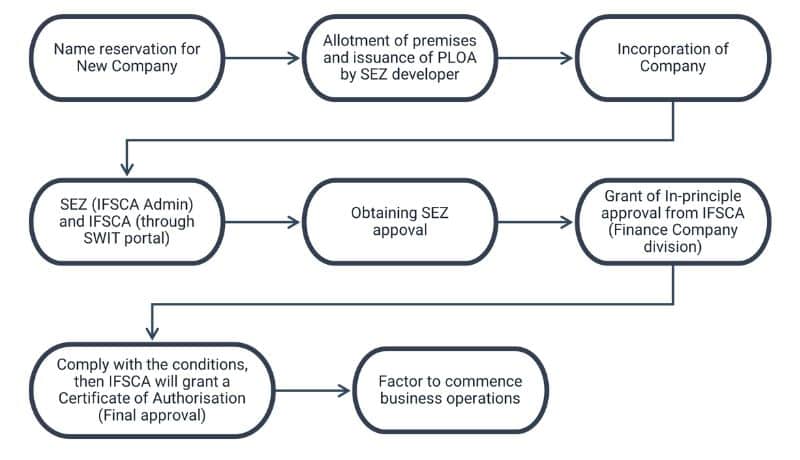

Process Flow for Setting Up in GIFT IFSC

Companies wishing to establish factoring businesses in GIFT City need to follow a predefined procedure set by IFSCA, ensuring compliance with local and international trade finance standards.

Regulatory Fees

1. IFSCA Fees for Finance Company / Unit:

| Particulars | Amount (In USD) |

| Application Fees (One-time) | 1,000 |

| Registration fees (One-time) | 12,500 |

| Recurring Fees (Annual) | 12,500 |

2. SEZ Authorities Fees (Now IFSCA Admin)

| Particulars | INR (₹) |

| Application fees (one-time) | 5,000 |

| Registration fees (one-time) | 25,000 |

| Recurring fees (annual) | 5,000 |

Conclusion

The establishment of a strong regulatory framework for factoring activities within the IFSC by IFSCA ensures commitment by the Authority toward development of a financial ecosystem that is transparent, efficient, and globally competitive. This effort is envisaged for the great benefit of finance companies engaged in such trade finance services under IFSCA. Currently, about 10 finance companies are registered with the IFSCA within core and non-core finance activities, out of which 3 are currently providing services through the International Trade Financing Services Platform or ITFS. As GIFT City in Gujarat continues to expand, it opens up even greater opportunities for global trade finance institutions, investors, and businesses looking to establish a strong presence in India’s leading financial services hub.

Why InCorp?

At InCorp, our team has extensive expertise in providing end-to-end support in the entire process of incorporating a Finance Company in GIFT City IFSC. The key service offerings are indicated below:

- Assistance with structuring the entity as per the regulatory requirement

- Advisory on regulations and tax implications for compliance and optimal structuring

- Assisting in preparing the requisite documentation and representation before the regulatory authorities for incorporation and licensing of finance entities in GIFT IFSC

- Assisting with the establishment of Finance Co. entities and support in post-incorporation compliance, if any for further inquiries on our services in GIFT City, please drop us a line at info@incorpadvisory.in or contact us at (+91) 77380 66622.

Authored by:

Kritika Raj Singh | GIFT City

FAQ

Any finance company that was registered and graced with a certificate of registration prior to the introduction of the IFSCA (Registration of Factors and Assignment of Receivables) Regulations, 2024, shall be registered even now under these very regulations. However, these companies must at all times comply with the provisions as applicable under the new regime.

Trade Receivables Discounting System (TReDS) is an electronic platform that supports trade receivables financing for enterprises. TReDS allows businesses to auction their receivables (invoices) to financiers for sale or discount, thus allowing them greater access to cash flow, liquidity, lower payment delays, and cost optimization.

Any factor that had received a certificate of registration under the IFSCA (Finance Company) Regulations, 2021, shall commence its factoring business within no more than six months from receipt of the certificate. In other words, if a factor does not commence within this period, it may seek an extension from the IFSCA or, if no such extension is approved, reapply once more.

In that case, the concerned entity availing of TReDS benefits shall make an application to the central registrar with valid explanations for the delay. On clearance, the entity would have to notify the central registrar within a period prescribed, or within ten days.

- Factoring is generally for short-term domestic and international trade whereby businesses sell the unpaid invoices for quick cash, while forfaiting is concerned only with large-value long-term international trade transactions whereby exporters sell future receivables with no risk of payment default.

Share

Share