Corporate Social Responsibility (CSR) in India: Business Impacts and Essential Changes between 2020 and 2025

Corporate Social Responsibility (CSR) in India: Business Impacts and Essential Changes between 2020 and 2025

Navigating India's Evolving CSR Landscape: Key Regulatory Changes and Their Impact on Business Strategy

- Authors

- Last Updated

- Tags

- Last Updated

- Authors

- Last Updated

- Tags

The History of Corporate Social Responsibility in India

If you’ve been following India’s Corporate Social Responsibility (CSR) journey, you might know that things have changed a lot in the last five years. Section 135 of the Companies Act, 2013, has now evolved into a formal, transparent, and accountable process. Thanks to improved regulatory reforms and disclosure mechanisms, the concept has shifted from a box ticking activity to greater contributory role towards economic and social development.

One big milestone in this field has been the publication of the Revised Technical Guide on Accounting for Corporate Social Responsibility Expenditure (2025 Edition) by the Institute of Chartered Accountants of India (ICAI).

The manual also introduced some notable amendments that, I feel, will aid in the formulation of Corporate Social Responsibility compliance policy documents in a streamlined and more effective manner.

Initiatives like ethical practices, donation campaigns, optimizing supply chains, helps a business to grow and enhance its reputation. In case of Regulatory compliances and other regulations, CRS initiatives help a business to mitigate risks.

However, how does CSR Impact a Business? What is the financial impact of CSR on a business?

It impacts a business in various ways. At its root, CSR goes far beyond profitability and shifts the focus on business’s impact on the environment, society and its beneficiaries.

This helps the business to improve its public image and brand reputation. A positive reputation helps in attracting loyal customers, retaining employees, and differentiating the company from competitors. In todays world consumers are more inclined to support businesses that align with their morals and values. CSR activities can boost customer loyalty, increasing repeat business, customer referrals, and long-term sales.

1. Changes that have impacted reporting accountability on Unspent Corporate Social Responsibility Funds

Back then, if any company failed to utilize its mandated Corporate Social Responsibility budget, it had to explain it in its Board’s Report. There was no pressure to spend or pay these budgets that led to massive expenditure and utilization expense inefficiencies in CSR Compliances.

Under the latest regulations

• Funds that are not allocated for any ongoing projects must be capitalized in a Schedule VII fund within 6 months.

• Funds allocated towards ongoing projects must be deposited into the CSR deposited account and must be spent within a maximum of 3 years.

Now, companies cannot just roll over unspent CSR funds indefinitely. They have to plan better, commit to real projects, and follow strict timelines. This change ensures that the money actually gets used for social causes instead of just sitting unused or being mismanaged. So, companies now need to be more strategic with their CSR planning instead of relying on financial year extensions or regulatory gaps.

2. Carry Forward of Excess Corporate Social Responsibility Spend

Companies that spent above the 2% statutory level had no provision to carry forward the excess against future expenses. This tends to discourage companies from making large, long-term expenses.

Under the latest regulations

Companies can now carry forward excess Corporate Social Responsibility expenses over a period of three years pending approval by a Board resolution granting the adjustment.

This amendment allows companies to engage in long-term CSR activities with more flexibility in India. It allows organizations to strategize and commit resources to successful projects without the limitation of budgets for one year. It also encourages businesses to take on larger projects that must be financed over time, such as rural development, medical centers, and education programs, and many more knowing that they will be capable of adjusting.

3. Definite Rules for Corporate Social Responsibility in Kind (Non-Cash Contributions)

Before the changes, it was not explicitly made known whether kind donations for e.g., goods or services must be accounted as CSR expenditure. Not many companies withheld non-monetary donation disclosure under CSR compliances because they did not have the required confidence in how they would be treated in a regulatory environment.

Under the latest regulations

•Whenever the business entity purchases goods or services (e.g., educational materials, first aid kits) and distributes them, it qualifies as Corporate Social Responsibility expenses.

•If a firm distributes goods or services produced by itself, it won’t qualify unless determined to be outside regular business activities.

This removes doubt and enables precise valuing and CSR reporting of in-kind Corporate Social Responsibility donations. Companies now have the luxury of being able to donate in-kind donations while conforming to compliance. However, companies need to be open when it comes to the valuation and reporting of donations so that they do not put auditors and regulators in difficulty. This provides clarity for businesses that donate resources like food supplies, educational kits, or medical equipment, ensuring these efforts are valued and recognized under CSR guidelines.

4. Increased Disclosure of Corporate Social Responsibility Spending in Accounting Statements

Previously, Corporate Social Responsibility spending would be reported as a line item in accounts with very few Corporate Social Responsibility Reporting disclosures.

Under latest regulations

Currently, companies are requested to provide an elaborate bifurcation of their CSR expense, categorizing it into different areas such as:

1. Cash contributions

2. CSR in Kind (donation of goods and services)

3. Purchase of Capital asset towards CSR activities

4. Related-party transactions (e.g., donations made to company-affiliated NGOs)

5. Opening and closing balances of unused or surplus CSR funds

The transformation improves transparency and facilitates tracking of CSR reporting and compliances requirements and expenditures habits. It also places stakeholders such as investors and regulators in a good position to identify a company’s Corporate Social Responsibility contribution. Investors, customers, and employees can now access more accurate information on how a company is contributing to society, hence enhancing corporate reputation and stakeholder confidence.

5. Stricter Corporate Social Responsibility Excess Management

Earlier, if the company generated any income or surplus from its CSR activities, no specific rules applied to the disposal of the excess. Some utilised it as a profit avenue.

Under the latest regulations

The new guidelines mandate that whatever surplus is earned out of these activities must be:

1.Spent on the same CSR venture, OR

2.Added to the Unspent CSR Account, OR

3.Desposed to a Schedule VII fund within six months.

This clause ensures that these CSR funds are held dedicated to their social impact purpose and not diverted or utilized for profit objectives. Corporates can no longer use CSR surpluses on internal business expansion or other non-social impact initiatives. It ensures financial accountability of CSR in India.

Also, organizations handling CSR projects for companies must register with the government by filing CSR-1. This ensures that only credible entities are involved in CSR implementation. And to prevent companies from using up too much of their CSR budget on admin expenses, there’s now a 5% cap on administrative overheads.

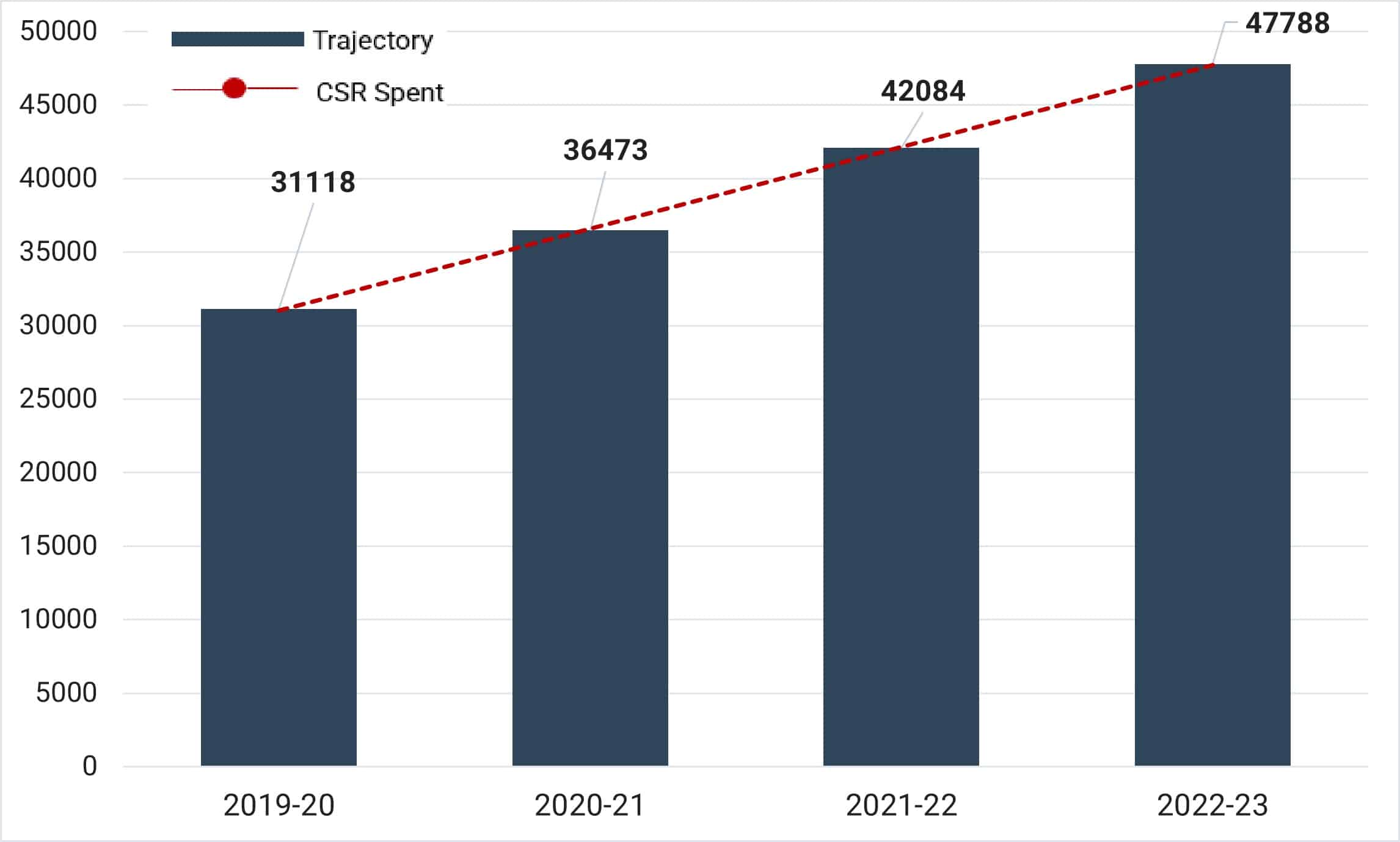

CSR Expenditure in India (2019-20 to 2022-23)

A Shift of Focus Towards Impact-Oriented CSR Strategies

In the last five years, India’s CSR Reporting and Compliance has developed enormously, which helped a great deal in the consistent growth of registration between 2020 and 2025. Companies had a social element as part of their business strategy, but today it is being considered as an objective in itself and has definite set social ROI. Firms can no longer treat CSR as a secondary strategy, now they must regard it as a core part of their corporate strategy.

With these changes, firms should:

1. Strategically plan CSR reporting activities to avoid last-minute shifting of funds and idle allocations.

2. Utilize the carry-forward facility for successful multi-year projects.

3. Document in-kind donations and related-party transactions appropriately.

4. Leverage transparent CSR reporting and CSR compliance to establish stakeholder trust.

With regulatory advancement, companies that lead the way in adapting to the changes will not only be compliant but will also be helping society advance. CSR in India is not about reaching milestones anymore, but about making actual, positive change. Investors, consumers, and society at large will reward companies that actively comply to a higher social standard, much better off than those that merely comply with the minimum legal standards.

Why Choose InCorp?

Navigating shifting landscape of CSR in India may be challenging and difficult. We help companies line up their CSR compliance plans with strategies that make a big difference over time, make the best use of what they have, and build more trust with everyone involved. With our help, businesses can do more than just follow the rules – they can make real lasting changes., you can contact us at (+91)77380 66622 or email us at info@incorpadvisory.in.

Authored by:

Riya Harikumaran | Assurance Services

FAQ

Contribution given to 'PM CARES Fund' will be CSR expenditure under entry no (viii) of Schedule VII of the Companies Act, 2013 and the same has been clarified further vide Office memorandum F. No. CSR-05/1/2020-CSR-MCA dated 28th March 2020.

If any ex-gratia payment is made to casual workers/ daily wage workers/ temporary workers in addition to the payment of wages, for the specific purpose of combat against COVID 19, the same shall be eligible towards CSR expense as a one-time exception on condition that there is a clear statement to this effect by the company's Board, which is properly certified by the statutory auditor.

The new framework requires unused amounts to be credited to a Schedule VII fund within six months or utilized on ongoing projects within three years. This new method constrains financial idle time, compelling corporations to live up to their promises.

Excessive CSR spending carried forward for three years make the atmosphere favourable for long term implementation of projects. This legislative amendment appears to have encouraged a culture where companies are ready to undertake multiyear initiatives without fear of yearly siphoning.

By asking for detailed breakdowns of spending on CSR—including cash, donated goods, and money invested in projects—plus disclosures on transactions with related parties, the new rules clarify things, prevent abuse of funds, and make stakeholders more assured.

By requiring firms to invest surplus funds into the same CSR initiative or keep it in a dedicated CSR account, or donate it to a Schedule VII fund, the new regulations ensure that the funds remain targeted towards benefiting society instead of enriching business.

Share

Share