Co-Investment by VC Scheme and Non-retail Schemes in GIFT IFSC

Co-Investment by VC Scheme and Non-retail Schemes in GIFT IFSC

IFSCA issues framework enabling co-investment by VC and non-retail Schemes at GIFT IFSC, allowing flexible investment structures

- Authors

- Last Updated

- Tags

- Last Updated

- Authors

- Last Updated

- Tags

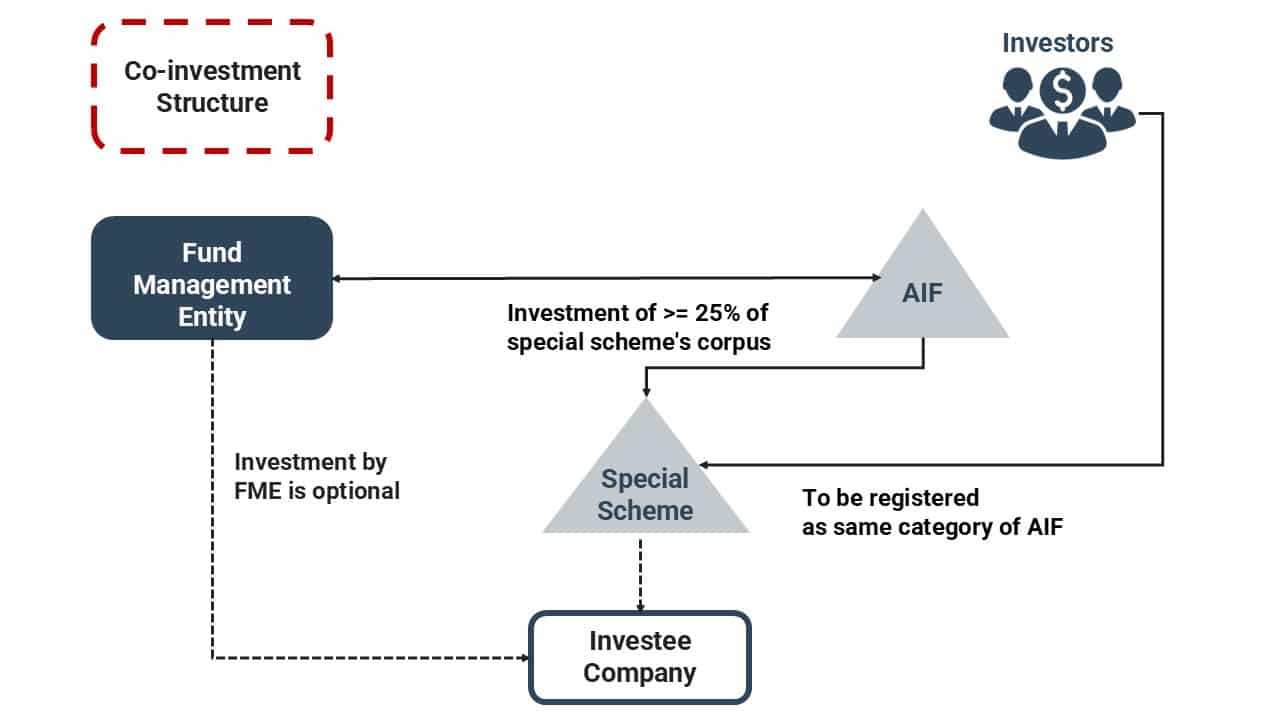

The International Financial Services Centres Authority (IFSCA) has published a framework to facilitate co-investment by the Venture Capital Scheme (VCS) and the restricted scheme/non-retail schemes through Special Purpose Vehicle (SPV) {referred to as the Special Scheme} at GIFT City. The purpose of this framework is to provide structured co-investment opportunities with or without leverage that comply with the IFSCA (Fund Management) Regulations, 2025. The non-retail schemes typically include Alternative Investment Funds (AIFs) catering to sophisticated investors, institutional investors, and high-net-worth individuals. The structured co-investment opportunities, with or without leverage, signify a flexible approach to funding. This flexibility allows for tailoring investment structures to specific risk appetites and returns expectations of both VCS and larger institutional investors. Read more to know the structure of the special scheme, permissible activities, investors and disclosure, compliance and other details

Structure of the Special Scheme

Related Read: Streamlining KYC Compliance: A Closer Look at IFSCA’s KYC Registration Agency (KRA) Regulations, 2025

- With the new framework, Fund Management Entities (FMEs) with operational VCS or restricted schemes may set up special schemes.

- The same needs to be registered as a Company, LLP, or Trust under Indian laws.

- It will be categorized as Category I, II, or III Alternative Investment Fund (AIF) same as the existing scheme. The existing scheme must hold at least 25% of the equity share capital, interest, or capital contribution in the special scheme.

Permissible activities in Special Scheme

- The special scheme will follow the investment strategy of the existing scheme. It will be permitted to invest in a single portfolio company (multiple entities only through corporate actions).

- It will have the same nature and duration as the existing scheme.

- If the existing scheme is liquidated, the special scheme will also be liquidated.

Investors and Disclosure

- Anyone may invest, subject to the minimum investment amounts prescribed by FM Regulations.

- A term sheet needs to be submitted within 45 days of the investment.

- The term sheet also needs to be accompanied by a declaration-cum-undertaking.

- Before seeking a capital contribution, investors of the existing scheme need to be informed about the special scheme’s establishment and be provided with a term sheet with all necessary disclosures as per regulations 24 and 36 of the fund management regulations.

Leverage and Control

- The leverage undertaken by the special scheme needs to be within the overall leverage limits as specified in the existing scheme’s placement memorandum.

- Encumbrance may be created over ownership of interests in favor of lenders.

- The Fund Management Entity, on its own, may contribute to the special scheme. The special scheme’s operation will be governed and decided by the Fund Management Entity; investors cannot stop regulatory compliance.

KYC and Reporting

Related Read: Empowering Growth of Trade Finance in IFSC

- For current investors to invest in the special scheme, the Fund Management Entity is not required to perform a separate KYC.

- But, in accordance with the IFSCA (AML, CTF & KYC) guidelines, 2022, the Fund Management Entity is required to perform the KYC before onboarding any new investors in the special scheme.

- Activities under the special scheme can be combined with reporting under the existing scheme.

Compliance and Fees

- All other obligations specified under the FM Regulations will apply to the special scheme.

- Each special scheme needs to obtain necessary SEZ approvals before filing the term sheet with the authority.

- Fees are required to be paid as per the regulatory fees circular dated April 08, 2025.

Related Read: Payment Service Providers (PSPs) in GIFT IFSC

Conclusion

This new co-investment framework from IFSCA is a welcome move for fund managers and investors looking for more structured and flexible investment options in GIFT IFSC. By allowing Venture Capital Scheme and non-retail schemes to collaborate through special schemes, it opens the door to more tailored investment strategies that align with varying risk and return expectations. With clear guidelines on structure, investor disclosures, and compliance, it not only simplifies the process but also builds greater confidence in the ecosystem.

Why Choose InCorp Global?

At InCorp, our dedicated on-ground team is committed to supporting your business journey at every stage. We guide you through the entire process, from incorporation to post-incorporation compliances, ensuring a smooth and efficient experience. Backed by a strong understanding of regulatory frameworks, we provide the necessary support to meet all compliance requirements seamlessly. To learn more about our GIFT City services, you can write to us at info@incorpadvisory.in or reach out to us at (+91) 77380 66622.

Authored by:

Kunj Solanki and Juhi Gahlot | GIFT CITY

Frequently Asked Questions (FAQs)

IFSCA’s Special Scheme lets VC and non-retail funds co-invest in portfolio companies through a separate entity. It offers a flexible, structured route for joint investments, with or without leverage, under the 2025 Fund Management Regulations.

Anyone can invest, as long as they meet the minimum investment amount. Existing investors don’t need fresh KYC, but new ones do. A term sheet and declaration must be submitted within 45 days of investing.

It must follow the same strategy, timeline, and structure as the main fund—and can invest in just one company (or related entities via corporate actions). If the main fund shuts down, so does the Special Scheme.

Yes. The main scheme must hold at least 25% in the Special Scheme to ensure alignment and control.

The Special Scheme needs SEZ approval, must follow all fund regulations, and pay fees as per IFSCA’s April 08, 2025 circular. Reporting can be clubbed with the main scheme for ease.

Share

Share