Family Trust in India: Benefits of Setting up Private Trust

Family Trust in India: Benefits of Setting up Private Trust

Understanding the benefits of family trust in India: Know types, objectives, importance and process of transferring assets

- Last Updated

Family trusts are incredibly effective and convenient. If utilized wisely, they can be a terrific instrument for succession planning and managing assets, money, and investing in securities, as well as using the trust’s earnings for the beneficiary’s purpose. In this article, we discuss the types, advantages and the process involved in setting up private family trust in India. e Indian Trust Act, 1882 has describes a Private Family Trust as: A Private Family Trust can either be a discretionary trust or a non-discretionary trust Beneficiaries of discretionary family trusts often have no control over any of the assets held in the trust or how they are distributed. The chosen trustee(s) manage the trust money and assets on behalf of the beneficiaries. The trustee has complete discretion over whether to advance payments to one or more beneficiaries or spend the funds on their behalf. Under a non-discretionary family trust, the trustee does not have full authority over distributing or paying out the trust assets. In some cases, one or more of the beneficiaries may have partial control over the distribution of the assets held in trust. In other cases, the trustee is required to distribute trust assets and income according to predetermined instructions. Listed below is the difference between discretionary trust and non-discretionary trust Furthermore, an asset can be transferred to a trust in the following ways: The regulations governing setting up of a family trust in India, allow Discretionary and Non-Discretionary family trusts to either be revocable or irrevocable. Revocable trust As an owner of a revocable trust, you may change the terms of the trust at any time. You can remove beneficiaries, designate new ones, and modify stipulations on managing the assets within the trust. As the owner retains such a level of control, the assets in the trust are not shielded from creditors. If they are sued, the trust assets can be ordered liquidated to satisfy any judgment put forth. Irrevocable trust In contrast, the conditions of an irrevocable trust are set in stone the moment the agreement is signed. The main benefit of creating an irrevocable trust is that it provides you with complete asset protection against creditors because the asset no longer belongs to the trust owner. The objectives and importance of setting up Irrevocable Family Trust are detailed below: Protection of Assets Autonomous and Accurate Control Preservation of Family Wealth Preservation of Family Values The settler can impose restrictions on the transfer of wealth/assets. The assets of the Trust can be utilised as a tool for preserving family values. For example, a trust deed could include a condition stating that the beneficiary will only be entitled to business revenue provided he looks after the family’s elders. Avoidance of Probate Immigration/Emigration Flexibility and Confidentiality Tax Planning tool Because a trust is a separate legal entity, it can be used for tax planning purposes. Subject to the Income Tax Act restrictions, one might organize the distribution of assets and wealth properly. The process of transferring assets through a trust can be summarized as under: A private family trust can be used to provide for specific family requirements, such as education, health, travel, or marriage, by acting as a vehicle that maintains assets specifically for that purpose, multiplying, safeguarding, managing, and securing them for that reason. Setting up a family trust in India can prove to be very beneficial for your family in the long run. We understand that regulatory compliance and succession planning can be complicated. Our dedicated team of family office management experts, legal professionals, tax and financial advisors who have the required knowledge and experience are happy to assist you. To learn more about our services, you can write to us at info@incorpadvisory.in or reach out to us at (+91) 77380 66622. Authored by: Yes, one can very well run a business through a trust establishment and/ or hold assets for the benefit of the beneficiary.

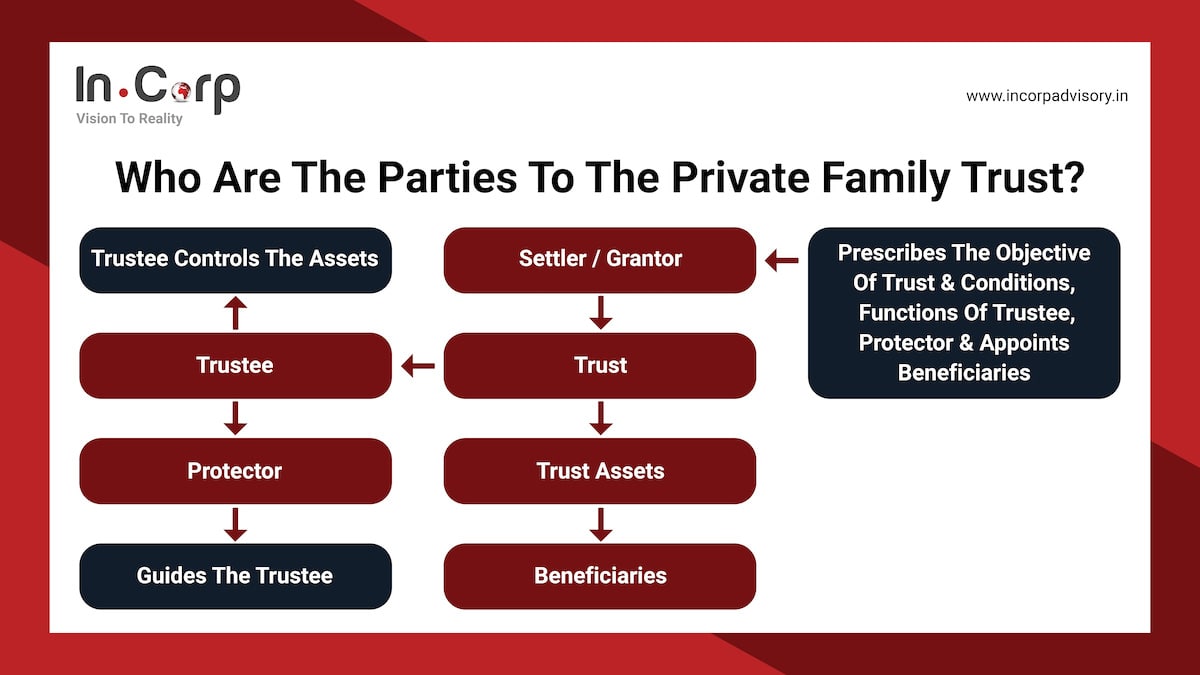

Who are the Parties to the Private Family Trust?

What are the different types of Private Family Trusts prevailing in India?

Discretionary Trust

Non-Discretionary trust:

Particulars

Discretionary Trust

Non-Discretionary Trust

Control and Power

It rests entirely with the Trustee/s

It rests with the trustees and partial control with the beneficiaries

Rights with Trustees

Discretionary rights

As per predetermined instructions

Distribution of income

Distribution is flexible with respect to income or capital

Not very flexible

Trust operations

The beneficiaries cannot interfere with Trust operations

Minor interference is possible.

Ideal Trustee

It is advisable to have a professional expert.

A knowledgeable family member. (Elders in the family)

When is it right time to create a trust?

The ideal time is when the beneficiaries are minor or vulnerable.

When beneficiaries are of sound mind and can make accurate decisions.

Cost of Trust management

You need to incur the costs of a professional trustee.

It is cost-effective.

Benefits of Trust

You can explore better investment options using the expertise of the Trustees. It can help generate higher and sustainable returns.

You can efficiently preserve ancestral family wealth.

What are revocable and irrevocable Private Family Trusts?

What are the objectives and importance of setting up irrevocable Family Trust in India?

What is the process of transferring assets through Private Family Trusts?

Conclusion

Why Choose Incorp?

InCorp Advisory | Family Office Frequently Asked Questions

Share

Share